The chief executive of Barclays, suggested during investor meetings that Barclays aims to become a self-oriented company, allowing staff to focus on added value. Antony Jenkins envisages a future in which the bank employs as few as 100,000 people (current strength ~140,000).

While this is being positioned as blue-sky thinking rather than a statement of potential job cuts, it got me thinking about how the advent of Digital Money is likely to impact what is closest to our hearts at Shift Thought, namely the creation of jobs world-wide.

Although services such as Barclays Pingit have been well received, banks have by no means been the leaders in the revolution. Based on our prioritisation analysis of the Digital money ecosystem, often the banks in a market really began to launch services as a defensive move, with the classic case being that of Kenya.

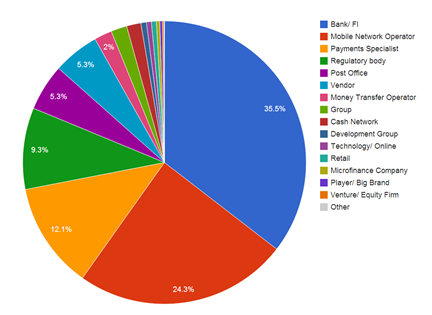

That being said, over 2013 we observe that certain banks are behind some of the fastest growing services in the world today. The chart shows the latest breakdown of the industry behind the launch of the 1000+ initiatives currently monitored by us.

But the way these banks are achieving transformation is by creating a whole new ecosystem, often with shared and interoperable infrastructure. By drawing new customers into their sphere of influence, they are not only creating jobs but also helping to further globally shared objectives such as the need to fight against money laundering (AML/CFT), the need to minimise the “leakage” that occurs in the distribution of benefits and aid and the need to support the burgeoning MSME segment in earning a living for themselves.

Perhaps this is one of the most effective ways for banks to regain lost ground and claw back some of the business they are losing to the likes of search engines, handset manufacturers, mobile operators and indeed even to risky services such as Bitcoin, that is now creating a whole ecosystem around it with venture capital investment. BitPay reportedly processed $5.2 million in Bitcoin transactions in March this year, and obtained $2 million in investment.

Over the next few weeks I’d like to share more about these hero services in Digital Money. These are the ones that have been catalysts in building an ecosystem, with not themselves, but customers at the very centre. Is it possible for banks to aim to not be self-oriented companies for a change, and use the enormous potential of multi-channel banking while still creating value, both for themselves and others? What do you think?

Very good question. Digital Money is an innovation that continues to have a tremendous impact on employment in the world. The introduction of ATMs did not reduce employment in the banking system, instead it helped increase the efficiency, reach and speed of the financial system. It changed the competitive landscape in the industry. Weaker and slower players were bought out. Credit cards and Paypal did the same. Innovations in mobile money will continue to increase the speed of, and dis-intermediation in, the consummation of many kinds of financial transactions. That is a good thing and will continue to increase the size and importance of the financial sector, perhaps without not much net new employment.

Fast digital money also increase the rewards and risks of quick actions, by governments and by private sector. Many governments in the Western hemisphere, like Greece and Italy, have effectively lost control over their super-complex financial systems. Thus fast money has the potential to accentuate some patterns whose success will not likely be rationally predictable. It will depend a lot on what activity patterns people choose to believe in, what kind of bubbles gets created, and what kind of gyrations that will lead to. Thus high speed of money can also indirectly boost or demolish the employment levels across the economy, be it in housing or retail or anything else.