Around the world the way people pay for travel is changing as people pay without pulling out a wallet. But does this work for everyone? In London this month chaos reigned as the London black cabs protested over the Uber app. This app works so well for passengers and for the new breed of private vehicles that use it that it cuts to the heart of the London back cab model, a business model that dates back to 1834. Although incumbents know that change is on the cards, it is not always easy to adjust.

London, UK – June the 11th 2014. The height of the tourist season in historic London. But I’m glad I was not out on the town that day. Here is what tourists generally enjoy.

By Arriva436 (Own work) [GFDL (http://www.gnu.org/copyleft/fdl.html) or CC-BY-3.0 (http://creativecommons.org/licenses/by/3.0)], via Wikimedia Commons

Sadly this picture of tourist heaven was rudely shattered when the black cabs went on strike. Who were they protesting against and what were they protesting about? Why did they have to strike to get their voices heard?

Horses disrupted

Back in 1834, London black cabs themselves disrupted horse drawn carriages, the first hackney-carriage licenses that date back to 1662. UK regulations define a hackney carriage as a taxicab allowed to ply the streets looking for passengers to pick up. The Uber app targets their competitors, the private hire vehicles (sometimes called minicabs), which may pick up only passengers who have previously booked or who visit the taxi operator's office.

The coming of the digital wallet

At Shift Thought we term 2011 as the year of the digital wallet. In the transport world we saw the launch of digital hailing applications for cabs in many parts of the world, including USA, India, China, Canada and even Azerbaijan. These operate through smartphones and include not just Uber, but a number of other such services GetTaxi and Hailo. Many of these applications also facilitate payment and tracking of the taxicabs. They are made possible because of the new access that consumers have through smartphones and digital wallet payment mechanisms.

The Uber App

The Uber App provided to private minicabs aims to provide a seamless experience to travellers, to enhance the experience of travelling through London. You can see how much a trip is expected to cost and book it with your smartphone app. You can see who will pick you up and when, on a map. Yet you don’t need to pull out your wallet to pay. It’s a card-on-file application that means no cash changes hands. Just one of the ways in which travel is going cashless in London.

A marketplace for cabs

Just as eBay created a marketplace for buyers and sellers on the Internet, and Amazon lets us sell those books we no longer need, the Uber App and others like it empower a new category of providers, lowering the entry barrier and letting the new entrants create massive value for customers.

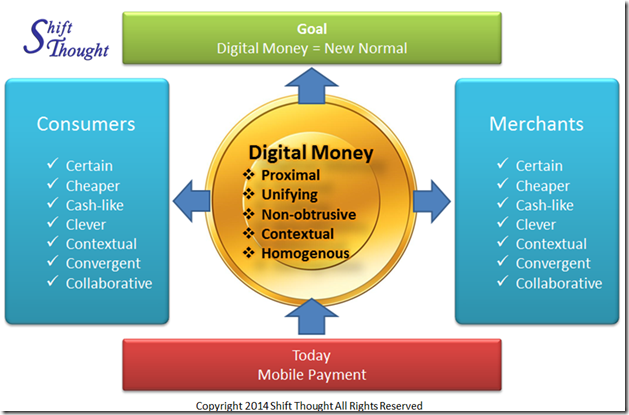

Let’s relook at the framework of the “7 Cs”, a model we at Shift Thought created back in 2011, to consider how to build services that please both consumers and merchants.

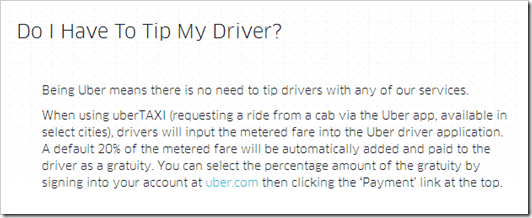

The Uber app ticks many of the boxes for the consumers and for the new set of cabbies it serves. A journey across London cost a mystery passenger from the Express.co.uk half the price of a black cab. For private cabs, it requires much less knowledge of streets as there is an app for that. It makes it easy for passengers to get a cab, trust a cab and make payments. I wondered if tips were down. Perhaps the new app does not make it easy to tip? But no, in actual fact a default tip of 20% is automatically added by the intelligent designers of this app. Here is what Uber advises on Tipping :

So merchants and happy. And customers are happy: Well those who travel regularly enough to use the app and have a payment card that they can register. The Uber app is like Oyster-on-steroids as it is tightly linked to an inexhaustible supply of real money. Created by Travis Kalanick and Garrett Camp, Uber now operates in 37 countries.

Unfortunately it leaves the incumbent merchants, our existing highly experienced London black cabs feeling “short changed”.

So what can those disrupted do?

There are no easy answers. The immediate course of action London black cabs are taking is to argue that calculating the final cost only after the journey is complete is a metered ride, only allowed for black cabs. This does not unfortunately address the issues at the heart of what’s really causing them pain. And this is the case in the 36 other countries where Uber operates. Will we see the demise of the talented cab driver who knows London like the back of her hand? Like horse carriages, will these be the “premium rides” we only take as a treat, and to remember the good old days?

Come join our Digital Money (open) group on Linked in to have your say on this. Are you the disruptor or the disrupted in the Digital Money Game that’s being played out around the world? Check out the 1900+ examples of new payment methods that we share on this portal.

If you’d like to know more about the Shift Thought Digital Money model and framework just pop us a note at contact@shiftthought.com . We shared our recent research through presentations just delivered at the London PayExpo 2014:

(1) Digital Money in Retail

(2) Mobile Money around the world

Let us know if you would like a copy!