I recently caught up with Kristian T. Sørensen (KS), Senior Manager Corporate Strategy at Nets Denmark to seek his expert views on payments in Northern Europe.

As a Member of the Board of Directors at Mobey Forum, Mr. Sorensen has helped to shape the direction of the development of mobile wallets and mobile payments in Europe. We discuss his experiences as Senior Manager, Mobile Payments and E-Commerce at Nets Denmark, and relating to his new portfolio. It was a privilege to understand more about the payments market in Northern Europe and his views on the future of mobile payments.

As a Member of the Board of Directors at Mobey Forum, Mr. Sorensen has helped to shape the direction of the development of mobile wallets and mobile payments in Europe. We discuss his experiences as Senior Manager, Mobile Payments and E-Commerce at Nets Denmark, and relating to his new portfolio. It was a privilege to understand more about the payments market in Northern Europe and his views on the future of mobile payments.

Founded in 1968, Nets is a key provider of payments, cards and information services in the Nordic market, as it manages key products including BankAxept, Betalingsservice, Dankort, NemID, Mobilpenge, eFaktura and Avtalegiro.

Please tell us a bit about yourself and your role at Nets

At Nets I was tasked with co-ordination of mobile payments and e-commerce initiatives across business units, and over the last couple of years those initiatives have matured and got absorbed into the appropriate business units. Recently Nets has been acquired by Advent International, ATP and Bain Capital and is in the process of growing the business, and I trust that mobile services including mobile payments will play an important role in this.

At Nets I was tasked with co-ordination of mobile payments and e-commerce initiatives across business units, and over the last couple of years those initiatives have matured and got absorbed into the appropriate business units. Recently Nets has been acquired by Advent International, ATP and Bain Capital and is in the process of growing the business, and I trust that mobile services including mobile payments will play an important role in this.

This is therefore an exciting time for me personally, as my current role in strategy includes direction for mobile payments. Things are really starting to happen, after many years of discussions, pilots and bilateral initiatives we are starting to see fundamental change and more interoperability.

Northern Europe has been in a leadership position in digital money. What changes have you seen in the way people pay?

Yes, Nets is fortunate to be working across the Nordics. In Denmark & Norway we enjoy a central position and we also operate in Finland, Sweden and Estonia.

The Nordic countries have been leaders in transformation to cashless payments. I was in one of the large Danish banks and part of the transition to digital banking. As people got access to the Internet at home, they found self-service useful and online banking really caught on. As smartphone penetration was also higher than in other regions we naturally expected to be leaders in mobile payments by default, but that proved not to be the case.

So, surprisingly regarding contactless card initiatives the Nordics were not first, nor the fastest!

This was because a number of the services we already have are so successful and cost-efficient. Card payment is widespread even for paying for just a cup of coffee. We needed more than just a new way to pay.

In Denmark it is not a problem living without cash.

I only carry currencies other than my own – I never need cash at home. With that in mind we had to deliver something that brings not just payments but also commerce to the next level. We had to look at mobile payments in a much broader context than just transactional payments.

We had to add context to payments to make the transition to mobile attractive to consumers.

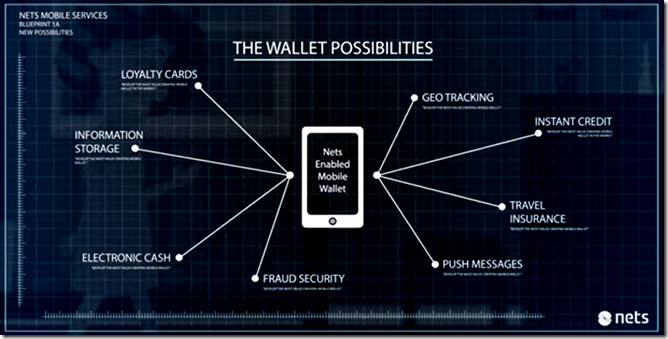

This links well with the work I do at Mobey Forum, devising wallets to broaden the reach of issuers, and value added services including coupons, loyalty and membership benefits. Although coupons are not widely used in the Nordic region, this is changing with recent new legislation that allows for an increased use of coupons. But although coupons may present an interesting use case, we can’t stop there.

One of the major drivers is IDENTITY, which underpins many use cases.

Identity services are important, and in this space Nets is a major provider as we run identity schemes in Denmark and Norway. All of a sudden once you solve the problem of digital identity, you start covering all the use cases the leather wallet supports: payment credentials, membership, loyalty, identity and more. In Denmark there is one identity all banks and authorities use and moving this to mobile is a key feature that will drive mobile adoption going forward.

Could you please share more about NFC, mobile payments and contactless payments using stickers in the Nordic region?

In Norway we are seeing mobile wallet solutions being brought to market – we are implementing a mobile wallet solution for Eika Kredittbank and in terms of contactless cards in Norway, more than 1 million are expected next year. In Denmark the first banks have started to issue contactless cards and recently an announcement was made to enable Dankort for contactless payment by Q3 2015. In Finland mobile payments have been widely used for some time.

Denmark and Norway were held back due to lack of acceptance infrastructure, as through a PCI compliance waiver terminals were not replaced. Over this year the situation has changed and 80-90% contactless terminals are contactless ready. Moreover, the kinds of terminals ready are those with very high transaction volume, at leading supermarkets for instance. So we expect a lot of initiatives to start now, and we expect contactless payments to pick up.

Sweden has been somewhat reluctant towards contactless & NFC. It has been different from the rest of the Nordics, with a more fragmented landscape, lots of trials and different concepts. This fragmented market has however impacted both issuers and merchants who are unsure and therefore reluctant to invest. With Apple committing to NFC now, Sweden is also expected to move in that direction. Nets have increased presence in Sweden through acquisition of a major POS provider and we are now in a better position to actively address the Swedish market.

Nets seem also well positioned to address Baltic markets including Estonia, Latvia and Lithuania. I see Nets has been chosen by Danske Bank as partner for entering the card acquiring markets in Latvia and Lithuania.

Yes, the Baltics have a lot of similarities to the Nordic countries, as well as being neighbouring countries. We find great benefits and synergies of working there as our services apply well to the Baltics.

Regarding the important issue of Tokenisation, I recently read an analysis from Mercator saying this may give more of the revenue to the network as opposed to processors. What is your opinion?

This is a natural evolution from the schemes for securing their place in the ecosystem. The whole card infrastructure was created to offer a convenient interface to bank accounts. To move money from bank accounts customers had to log in. Cross-border transactions in particular were a problem. Now with the spread of mobile devices we carry our own piece of infrastructure with us. The access to bank interfaces is not far. Card schemes need to consequently extend their business to remain relevant. This is where tokenisation comes in as it provides new level of convenience to payments and also makes secure transactions easier.

Does it fit naturally into existing payments? PayPal also has its own different way of securing online payments.

To reduce fraud we must readdress where we hold sensitive information to avoid incidents such as the Target breach. Consumers shop more online and need to pay but don’t want to leave payment information with merchants. In the physical world, you’d not want to leave your payment card at a store. Instead of leaving full credentials at merchants they can get paid conveniently without having to control all the payment data. Tokens can be limited in different ways, for instance by duration, amount and where used.

What are your views for the outlook of NFC and mobile payments?

Through the recent years there has been an on-going expectation, but now with Apple supporting NFC through the launch of Apple Pay and the iPhone 6 capabilities the outlook has improved. We are likely to see issuers and merchants driving many kinds of initiatives – not one size fits all. We see the confidence in the market and there will be a snowball effect on mobile payments and mobile commerce.

The estimates of mobile payments have so far exceeded the actuals, not unlike the time of the advent of the Internet. Yet looking back, even the most optimistic could not predict how big Google could be, how big e-commerce would be and how much we would end up today using internet and mobile. Similarly I don’t think we can even start to imagine how big mobile payments could be down the road!

What do you see to be the future of Nets & future of payments?

The growth of payments industry does not just hinge on the mechanics of payments. Moving money from one account to the other will be commoditised. But the general exchange of valuables in a connected world fuelled by mobile is the truly important thing.

In this, players like Nets have a significant role to play. Broader exchange of valuables includes coupons, loyalty points and more. What is required is a trusted broker of valuables: at a supermarket you could tap your phone and instead of paying £89 for grocery, you might pay 4,000 Avios points, some Starbucks points and store points– you may get the groceries without using money.

Thanks very much for this fascinating interview. Wish you the very best in your new role and for the exciting work planned at Nets.

Kristian T. Sørensen (KS), Senior Manager Corporate Strategy at Nets Denmark. Prior to this, Kristian spent ten years working within online and mobile financial services at Danish Bank, Nykredit. Kristian holds a master’s degree in Communication and Psychology, and has worked with online solutions since the early days of the Internet in the mid-1990s and with online financial services since 2002. Kristian has participated in Mobey Forum since 2010 and has been an active contributor to the production of mobile wallet white papers. He was elected to the Board and Chairman of the Marketing Work group in 2012 and is a sought after Speaker and Thought Leader in the field of Payments.

Charmaine Oak

Author of The Digital Money Game, co-author Virtual Currencies – From Secrecy to Safety

![clip_image002[1] clip_image002[1]](http://digitalmoney.shiftthought.com/files/2014/09/clip_image00211.jpg)