The origins of Mahindra Comviva date back to 1999. Since then the company has enabled mobile operators and financial institutions around the world to address opportunities presented by money going digital. As part of Shift Thought’s assessment of the state of the market, it was a real pleasure to speak to Srinivas Nidugondi, to obtain his views on the latest trends and future directions. In this post I share highlights of our discussion on mobile money and mobile financial services.

Srinivas, thanks for your time today. Could you please give us a bit of background about your expertise and your role at Comviva?

I head the mobile financial solutions unit at Mahindra Comviva. For four years now, I head the entire commerce portfolio within Comviva. We have 3 verticals that include commerce, content and data, all with the underlying theme of mobility.

I head the mobile financial solutions unit at Mahindra Comviva. For four years now, I head the entire commerce portfolio within Comviva. We have 3 verticals that include commerce, content and data, all with the underlying theme of mobility.

Within our horizontal of managed services, our fastest & largest pillar is commerce. I look at the overall opportunity, to grow our operations into a leadership position. I have a background in banking and payments, commerce and smartcards. My last position was at ICICI bank where I was Head of Internet Banking platform and Mobile Banking and worked on the launch of ICICI’s first mobile banking app 8 years ago; further I was involved in a collaborative offering with Vodafone to cater to the unbanked and under banked segments in India.

Could you please give us a brief background about Comviva?

We’ve been around for 15 years, beginning with the Telecom Revolution in India and other emerging markets focussing on products that would help mobile operators, in our capacity as part of the Bharti group.

We’ve been around for 15 years, beginning with the Telecom Revolution in India and other emerging markets focussing on products that would help mobile operators, in our capacity as part of the Bharti group.

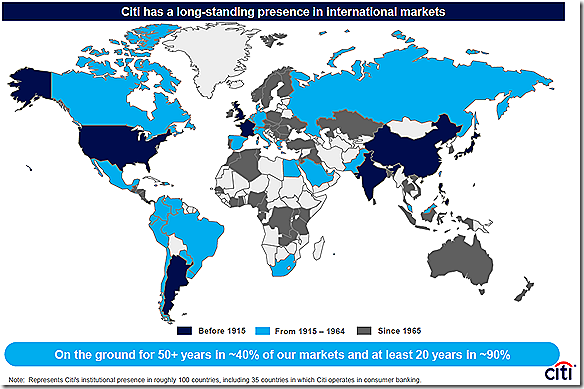

Our mobiquity® Money solution now has over 50 deployments in 40 countries, enabling over 35 million registered customers to transact approximately USD 13.5 billion transactions annually.

Over the last five years we have streamlined and also broad-based our focus. As a product company we complement Tech Mahindra’s IT services and also obtain access to new geographies, such as our recent forays into North America, Europe and Australia. Further, we have been able to penetrate into Latin America with several deployments on-going across the region.

Could you give us highlights of the kinds of products and services, and the kind of competition you face?

In our mobile financial services unit our philosophy is to leverage mobility, commerce & payment services. What this means is we do not just focus on providing payments solutions but are experts in the whole commerce process. Also we have refocused from mobile to mobility, to cover new devices that I expect will become an active part in the way people transact, for instance through wearables like Apple Watch or Google Glass.

We focus on payments behaviour within each segment that includes consumers, businesses and merchants. So we look at a diverse set of scenarios that range from under banked consumers to evolved consumers to large merchants. We are one of the largest providers for Mobile Money in the world, with services provided to pretty much every major mobile operator.

We are going up the value chain with services such as mobile wallets, mobile payments, and QR codes, BLE, HCE, NFC and Apple Pay and offering these solutions to banks, processors and retail industries apart from the traditional customer base of telecom operators. Our recent customers include banks in the North America and Asia pacific regions as well as a new age retail chain in South America. And further, we are working with a telecom operator in Europe for launching NFC based payments. Our competitors include for instance C-SAM, Toro, Airtag and Monetise.

On the business and merchant side we offer an integrated payment solution payPLUS that allows both large and medium merchants as well as SMEs to use their mobile phones as a POS, and we work with First Data and not just small & medium - there is a market for mobility based for insurance, e-commerce down to small and medium.

We are entering the US through one of the largest processors where competition is different. We don’t really see Square and iZettle as our competition as we don’t go direct to market but rather work with banks and processors. We also face localised competitions such as from Easytap in India.

What are some of the major implementations you’ve been involved in around the world?

We have over 50 mobile money implementations including a number of implementations with Airtel, Orange, Econet Wireless, Grameenphone, Banglalink, Tigo and others. In Bangladesh we are deploying with DBBL, one of the largest banks in the country.

We are working with First Data and other large processors and also with some of the largest banks for HCE, MasterPass. We are with the largest 4G operator in India for Mobile POS and Mobile Wallet. Some of our latest wins include a retailer in Chile, and US work with a processor for mobile POS, and a wallet for a bank in Canada.

In 2014, mobile money service became interoperable in 3 new markets. Could you tell us a bit about how this works and how effective this strategy has proved?

I don’t think every market could be a success. This is a function of multiple factors. In Kenya Safaricom became successful with a position of leader in the mobile business. Now Tanzania is becoming an overall leader in mobile money, but there no one operator has a monopolistic position.

Mobile money has taken off where there is low banking penetration and high mobile penetration. Agents must find it viable. Also the services need to go beyond just P2P or Cash-in/Cash-out. People must not just withdraw cash but make payments through their mobile money account. That is when profitability goes up.

It is also really important to be able to offer remittances. There is a service called Terra that is getting all the operators together for this to make the money flows easier in corridors such as Mozambique to Malawi, Zimbabwe to Malawi and South Africa to Zimbabwe.

If each operator has say a maximum of 40% market share, this means that 60% of the market is excluded, so interoperability is not a luxury but is critical for operators to explore in each market.

What are some of the other trends you observed in mobile money in 2014?

Mobile Money is used in a developmental context, where third party provides bring financial services to people who don’t have access to them.

I observed three key trends in mobile money over 2014.

Firstly, the evolution to cover more services has been recognised to be of huge importance. From cash-in/ cash-out, it is now about enabling every transaction that people have to make. So this is interoperability in the context of payments.

Secondly, there is a focus on interoperability in the context of remittances. We saw a spurt in transactions with Tigo and Airtel making their transactions interoperable in Tanzania.

Thirdly, it’s about how to build a path to offer a full suite of services, not just mobile money. We’ve had to solve for enabling payments, micro-loans, investments and insurance, so as to build a “One-Stop Shop” for all these services.

Did regulations have to change in order to enable these trends and new services added over 2014?

No I think the regulations did allow it, but it was a matter of the maturity level having grown over the last 3 years. As this grows further we’re seeing more such examples in Tanzania, Zimbabwe and elsewhere.

What is the outlook for mobile money going into 2015?

I see an evolution of the services to straddle multiple areas. From over-the-counter and one time transactions it’s now all about the mobile wallet. This needs a better understanding of the end-to-end customer journey and experience.

Srinivas, thanks very much for your time today. It has been a great pleasure speaking to you. I wish you the very best for your success in 2015 and beyond.

|

Srinivas Nidugondi is Senior Vice President at Mahindra Comviva, based in Bengaluru, India and has led the Mobile Financial Solutions area in Comviva since 2011. Srinivas brings a keen interest in financial inclusion, especially as enabled by mobile phone and digital channels and has a wealth of experience in banking, payments, Internet and e-commerce. He set up & led the business for online banking and mobile payments in a large multinational bank and has led product management & business development in start-ups and IT product companies. |

Author of The Digital Money Game, co-author Virtual Currencies – From Secrecy to Safety

http://www.linkedin.com/in/charmaineoak

Join me on Twitter @ShiftThoughtDM and The Digital Money Group on LinkedIn