As we continue to experience regular occurrences of Bitcoin volatility, I wonder if and when Bitcoin might become too big too fail. As it continues to go mainstream if its Achilles Heel of Volatility gets further exposed, and the worst happens, who will care? If we visualise the rescue meeting, who is likely to accept a seat at the table?

Bitcoin, together with Altcoins and alternative currencies continues to excite interest across multiple segments around the world. In spite of warnings from CFPB, FATF, EBA and other regulators, news of Bitcoin related conquests continue to come thick and fast.

One thing that experts seem to agree about is that this is not going away any time soon. But as the movement gathers momentum and becomes increasingly entwined with mainstream ecosystems, a lot more businesses and consumers could potentially stand to lose if the services were to fail.

Reportedly Bitcoin is making strides in Australia. Living Room of Satoshi reports that Australian residents have paid $150,000 toward BPAY-enabled utility bills, electricity bills, school fees and tax payments through their service. BPAY is an important bill-payment system in Australia and supports innovative ways to pay through digital banking, QR Codes and more.

Bitcoin bill payments is also happening in Canada, and elsewhere in the world too, Bitcoin is becoming a part of everyday life. Overstock plans to launch International Bitcoin Payments on September 1st. Yet, more bill payment and more retail payment may not necessarily translate to Happy Days. Retailers need fiat currency, and the more the mainstream services, the more the potential exposure to currency quirks.

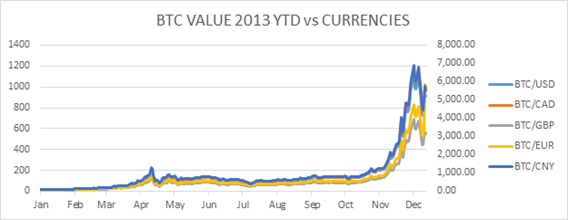

As prices declined this week, and Bitcoin experienced one of the most volatile periods this year, reportedly going into a 38% free fall in some areas yesterday, I wonder whether the industry is already showing signs of age. Still in the first flush of growth, the industry must nevertheless go through all the growth phases of its predecessors, however different they may seem. But when teenage angst gives way to middle age worries, who will take care of Bitcoin?

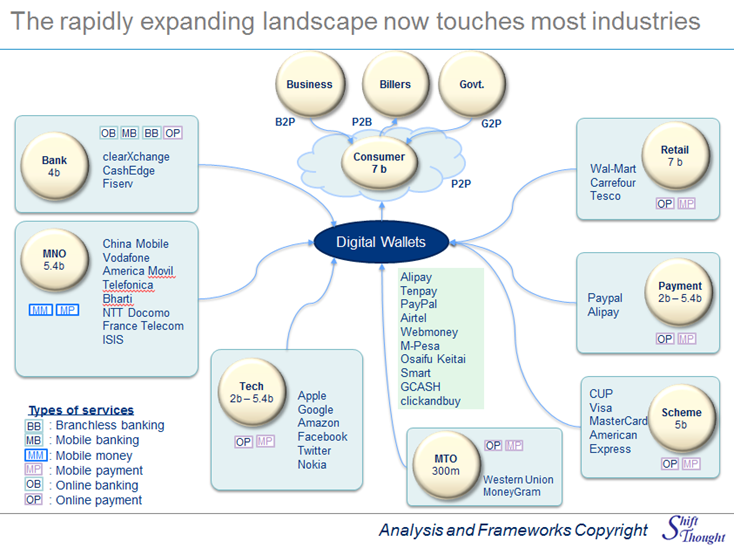

Studying trends in Digital Money as we do, it seems as if each wave of new entrants and services seems indomitable at first, but may be brought down by some of the very factors that at first made it successful. Mobile money services can find it hard to support the very high volume low value transactions that are their reason for being. Money transfer operators feel the heavy burden of compliance due to the highly specialised nature of their business and their sprawling agent networks that made them successful for so long. And we all know what happens when banks become too big to fail: every one gets roped in to take care of them. But more importantly processes exist for detection and correction in these industries, and remedial action can proceed along well understood lines.

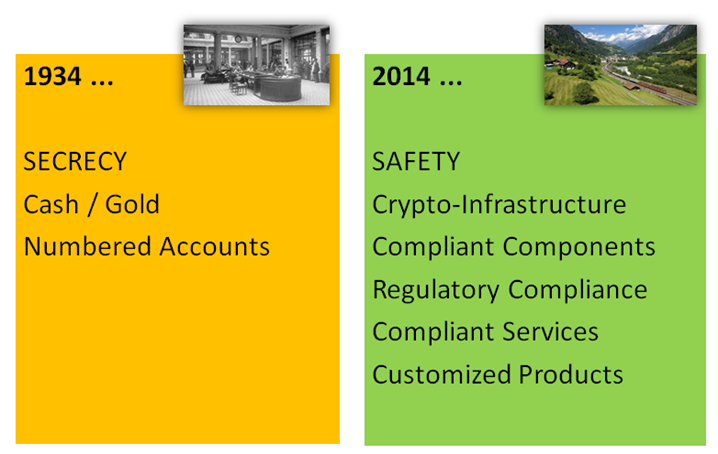

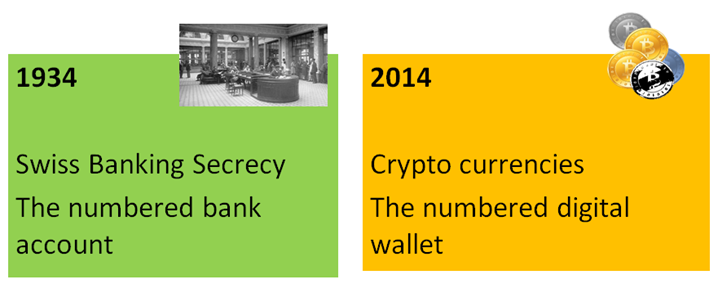

As the Cryptocurrency industry enters it’s sixth year, some of the processes have already been streamlined for efficiency. However this very maturity is exposing its Achilles heel of Volatility in new ways. The fact that it is possible to attack a pool more easily than the same number of independent miners, for instance, raises new possibilities for attacks as we saw recently. At the start of the month one hacker was revealed to have stolen $83,000 over four months by targeting a mining pool and using a vulnerability in the border gateway protocol.

A number of incidents, such as Mt. Gox have brought home the vulnerabilities of doing business involving Bitcoin. When traditional businesses fail, there are fall backs typically at the country or economic zone level. If the industry is to grow out of adolescence is it possible to put trusted guardians and a protection mechanism in place?

Cui Bono? Although it is clear that everyone stands to benefit from their being such a mechanism, it is not clear who stands to benefit from being such a mechanism.

Yet this will be vital for when cryptocentric systemically critical services such as Bitcoin need to be stabilised or bailed out. Otherwise the knock-on effect to other parts of the ecosystem will increasingly translate the shock onward, not just to Litecoin, Darkcoin and other cryptocurrencies as recently happened, but even to external entities that may seem totally disconnected at present.

![image_thumb11[1] image_thumb11[1]](http://digitalmoney.shiftthought.com/files/2013/12/image_thumb111_thumb.png)