Blog 3

Dr. Neeraj Oak examines the history of Bitcoin, and looks at the connection between price and publicity for this ground-breaking technology.

Wiser heads than mine have examined the history of Bitcoin, from the initial registration of the Bitcoin.org domain on August 18th 2008 to its more recent price volatility and regulatory concerns.

In this blog, I’d like to highlight a few of the events that I think are the most notable, mainly due to the effect they’ve had on how potential consumers and investors view Bitcoin. As I do so, I will also mention what effect each event had on the closing price of Bitcoins on that day.

After its initial foundation, Bitcoin continued almost unnoticed by the wider world. For instance, the first time any noticeable number of people typed ‘Bitcoin’ into Google was February 2011. And even then, it barely scraped a search intensity score of 1/100.

Around this time, the infamous drug black market, ‘Silk road’ was founded. Silk road offered users a selection of drugs, pharmaceuticals and chemicals, and protected both buyer and seller from prosecution by using Bitcoin wallets to make payments. Since neither party needed to reveal any personal information to obtain these wallets, transactions were, at the time, practically untraceable. Being something of an open secret, Silk Road’s foundation didn’t have much of an effect on the price of Bitcoin, which oscillated between $0.3 -$0.5 in this period.

Litecoin, an early and influential alternative cryptocurrency was established in October 2011, while the price of Bitcoins was between $2- $5. Litecoin has become the biggest ‘Altcoin’ in circulation today, with a market capitalisation of around $320 million. The emergence of new alternatives to Bitcoin would speed up after this point; at the time of writing, there are over 300 cryptocurrencies in circulation worldwide.

In September 2012, Bitcoin made its first move towards mainstream acceptance with the establishment of the Bitcoin Foundation, a lobby group whose aims were to "standardize, protect and promote the use of Bitcoin cryptographic money for the benefit of users worldwide". Bitcoins were worth between $9- $13.

Bitcoins continued their upward trend in price, albeit with a few wild lurches up and down. The Winklevoss twins, of Facebook fame, filed the bitcoin trust on 1 July 2013. Up until this point, Bitcoins were viewed as a very high risk venture, beyond the tolerances of mainstream investors. The Winklevoss vote of confidence marked the start of a trend in which wealthier investors began to put some of their money into bitcoins, albeit by indirect means. Bitcoin prices rallied briefly, but in fact fell 31% over the next 5 days.

Remember the Silk Road? The FBI certainly did. On October 2nd 2013, they raided and shut down the online drug bazaar, causing a temporary dip of 20% in the Bitcoin price; it more than recovered within a week.

On October 29th 2013 in Vancouver, the first ever bitcoin ATM opened. At last, users of bitcoin could transfer conveniently between fiat money and bitcoins. Over the next week, prices rose 17% to around $240.

By this time governments around the world were giving serious attention to Bitcoin and cryptocurrencies in general. On 19th November 2013, a US senate committee heard strong praise for Bitcoin, describing it as ‘legitimate’, but also conceding that it had been ‘exploited by malicious actors’. Bitcoin prices rallied strongly, more than doubling to a peak of $1147 over the next 2 weeks.

But what goes up, as the old adage says, must come down. In this case, spectacularly. On December 5th 2013, China effectively banned Bitcoin, as its central bank barred financial institutions from handling Bitcoin transactions. Over the next two weeks, prices almost halved to a low of $522.

Norway made its mark on the history of Bitcoin on December 13th 2013. It declared that Bitcoin should be taxed like an asset, which has significant tax ramifications and could change the equation for large-scale Bitcoin miners and retailers. Prices fell after this announcement, but this could be partly attributed to China’s ruling earlier that month.

Warren Buffett has been a respected commentator on the business world for years, and his statement against bitcoin on 14 March 2014 appeared to deal a significant blow to investor confidence in Bitcoin. In an interview, he was quoted as saying ‘Stay away from it. It’s a mirage basically’. Prices actually rose the next day, but within a month they had nearly halved to around $300.

Further tax rulings and clarifications have been made by the UK (3rd March 2014) and the USA (25th March 2014), with mildly negative responses from Bitcoin prices.

Finally, I’d like to highlight one important landmark in the acceptance of Bitcoin by online retailers. Overstock agreed to accept Bitcoins on January 9th 2014. With an annual revenue in excess of $300 million, Overstock’s faith in Bitcoins may well cause other retailers to follow.

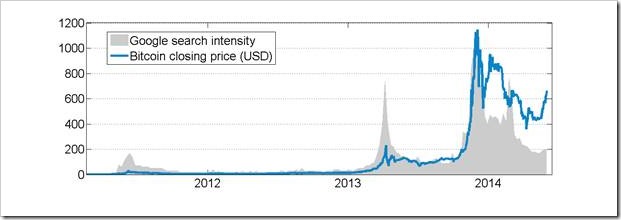

The chart above is a good guide to the most volatile years of Bitcoin’s existence. On it, I’ve drawn the closing price of Bitcoin at each day for the last 3 years (blue line). I’ve superimposed this with an index (from 1 to 1000) of the number of Google searches made for the word ‘Bitcoin’, where the higher the index, the greater the number of searches. This forms a useful proxy for the publicity, or at least the public interest in Bitcoin. Looking at this chart, a few interesting points stand out.

Notice that spikes in Bitcoin prices correlate very well with publicity in the period up to 2014. Indeed, they appear to coincide almost perfectly. As a scientist by training, I feel obliged to point out that correlation is not causation, and that publicity could just as well be a symptom of rising prices as a cause. But it’s hard to deny the link between them.

However, in 2014 this link appears to have broken down. Indeed, peaks in publicity appear to occur more often during price minima. How should we interpret this sudden change?

Partly, I think this is a sign that the novelty stage of cryptocurrencies is drawing to a close, as larger firms move into the space. By now, the bulk of the population may also have had a chance to become acquainted with cryptocurrencies due to extensive media coverage.

It could also be explained by the predominance of speculation in cryptocurrency markets- perhaps people just aren’t surprised any more when Bitcoin leaps in value, or comes crashing down.

Whatever the cause of this breakdown between the correlation of publicity and price, it opens up a significant opportunity; when prices aren’t sensitive to daily news, it might be possible to introduce reforms to Bitcoin without debasing its value.

Join me for my next post, in which I look at the mechanism through which Bitcoin operates.

Meet Shift Thought at: