Rakhi Sahay, Shift Thought distributor in Indonesia shares her thoughts on the payments scene in Indonesia as the regulators seek to encourage financial inclusion through branchless banking. What are some of the sticking points and how can Indonesia join the ranks of other countries where these services have already entered into mainstream use?

Impressions of an Indian in Indonesia

We moved to Indonesia in June 2012 and it’s been wonderful living here since. Yet a few things came as a surprise, for instance the way people pay. Coming from India where people now increasingly use card payments, having to pay with cash took me back a bit. We had heard about the widespread use of cash for transactions in Indonesia but I had not imagined it to be at such a high level. While doing provision shopping even in big departmental stores, I was taken aback when cashiers did not accept local bank debit cards that I was using – “sorry we only accept X bank debit card or cash”. Generally the small shops and stores that do business along the street only transact in cash in spite of having customers from middle income groups who have bank accounts and can make payment by card.

My interest in branchless banking and payments was further triggered by an informal c onversation I had with my help, Fatimah. Every month she sends money to her mother who lives in a village. For this she goes to the nearby bank to deposit cash into her mother’s account. I got talking to her to learn about how people from her village who work outside send money home or pay their utilities. Do they use mobile technology for purchase and payment? Do they know about some of the new services being launched by banks, mobile operators and other providers in Indonesia?

onversation I had with my help, Fatimah. Every month she sends money to her mother who lives in a village. For this she goes to the nearby bank to deposit cash into her mother’s account. I got talking to her to learn about how people from her village who work outside send money home or pay their utilities. Do they use mobile technology for purchase and payment? Do they know about some of the new services being launched by banks, mobile operators and other providers in Indonesia?

Fatima knew about mobile banking and in fact had the m-banking application of Indosat on her mobile. However although she knew about the functionality it provides, she does not use it or plan to use it. She does not have a bank account which she believes is needed for mobile payments and transfers and also does not regard transferring through bank as a reliable and secure mode of transfer. Come to think of it, I too have not felt comfortable with using my mobile for payments. My interest was piqued and I chatted with others close to me and both banked and unbanked people tended to have some reason for not yet investigating the new methods available.

This conversation made me wonder - what needs to happen for myself and Fatimah, along with millions of other Indonesians to benefit from innovations to enjoy more convenient payments? If I feel restricted in making transfers and payments, how would people from remote islands and lower economic segments manage their daily needs? Do we need to change the mind-set of people? How can we increase accessibility to gain confidence? Surely branchless banking can add much value for people who have limited access to banking facilities.

This conversation made me wonder - what needs to happen for myself and Fatimah, along with millions of other Indonesians to benefit from innovations to enjoy more convenient payments? If I feel restricted in making transfers and payments, how would people from remote islands and lower economic segments manage their daily needs? Do we need to change the mind-set of people? How can we increase accessibility to gain confidence? Surely branchless banking can add much value for people who have limited access to banking facilities.

Regulations play an integral role in providing a favourable ecosystem for any new banking initiative to flourish. Bank Indonesia, the regulator, has been treading the path carefully and its first pilot which ran from April 2013 just ended in November 2013. The regulators are now consolidating results and by early 2014 intend to roll out the full regulations on branchless banking. Many providers await this in order to obtain the certainty required for investing in the new technology and marketing efforts required to successfully launch the services for all sections of society.

Regulations play an integral role in providing a favourable ecosystem for any new banking initiative to flourish. Bank Indonesia, the regulator, has been treading the path carefully and its first pilot which ran from April 2013 just ended in November 2013. The regulators are now consolidating results and by early 2014 intend to roll out the full regulations on branchless banking. Many providers await this in order to obtain the certainty required for investing in the new technology and marketing efforts required to successfully launch the services for all sections of society.

The Market

The country is one of the early entrants in offering financial services through microfinance activities. Although there are a range of service providers to cater to different socio-economic groups, only 19.6% of the population has formal accounts (2011 Global Financial Index). It is estimated that around 100 million Indonesians do not or cannot access formal financial services in a population base of 250 million.

The vast geographical expanse and remote terrain creates hurdles in the provision of financial services. This creates a potential opportunity for alternative channels such as branchless banking and mobile money. Branchless banking is the delivery of financial services outside conventional bank branches through the use of retail agents and information and communications technologies to transmit transaction details (as defined by CGAP).

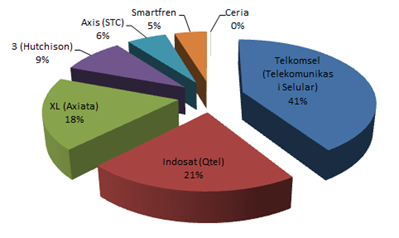

In 2012 there were 260 million mobile subscribers with 143 million unique subscribers. Only half the numbers of people possess bank accounts as compared to unique subscribers. The opportunity has been spotted, but scope for adoption remains immense. Branchless banking with the use of mobile technology and agent networks is rapidly improving financial inclusion in countries around the world. Mature microfinance markets of Bangladesh, Pakistan and Kenya have been able to achieve rapid adoption rates. Can Indonesia too leverage the penetration of its mobile technology to foster financial service? The large base of mobile users makes it easy for service providers who do not need to educate the masses on mobile usage.

Regulatory Environment

The regulators have been moving cautiously towards creating the regulatory environment required for this. A new regulation of December 2012 allows full encashment for person to person transfers using mobile wallets at agents. Then in April 2013 regulator Bank Indonesia (BI) released guidelines on branchless banking for banks and MNOs. The move caused MNOs to refocus on strengthening agent networks. As a pilot initiative, BI mandated five banks – Bank Mandiri, Bank Rakyat Indonesia (BRI), Bank Sinar Harapan Bali, Bank Tabungan Pensiunan Nasional (BTPN) and CIMB Niaga to offer branchless banking across the country, to cover rural and remote areas as well. The initiative is looking at bank-led, telco-led and hybrid models, to be tested under this program. The banks are also mandated to include provision store owners, gas stations and business outlets as agents in order to extend financial services to the excluded.

Progress of Branchless Banking Pilots

Reports on the progress of pilots suggest that the participating banks are able to see positive results in implementing branchless banking. Customers, in particular local business, homemakers and students benefit from more convenient access.

Banks have gained an increase in the number of new customers as well as agents. Bank Sinar Harapan Bali, a subsidiary of Bank Mandiri, reported an increase in new customers and agents and aims to double the number of agents. Similar information is reported by BRI, another state-owned bank, who is has reported around 200 transactions per day which is equivalent to daily work of one teller.

Going beyond pilots

The pilot has got many other banks and MNOs interested in branchless banking. But they are waiting for the regulator to open-up and also look at results from the pilot phase. The regulators are also considering inclusion of BDPs (regional development banks) to increase accessibility at regional levels. Bank Indonesia now plans to review the pilot phase and look at pan-country roll-out of branchless banking.

The power of mobile technology in expanding the reach of financial services is immense. It is encouraging to see regulators in Indonesia taking informed decisions in formulating regulations in this space. Indonesia has the advantage of being able to learn from other countries that now have mature branchless banking markets. Pre and post roll-out, it might be useful to take a closer look at such successful markets in terms of product offerings, agent selection, processes and platforms. Over 2014 much can be achieved through proper training of agents, pricing and commission strategies and marketing and communications.

Rakhi Sahay, Shift Thought distributor in Indonesia, is a development professional with a deep interest in innovative channels that drive inclusive development. Rakhi’s interest in branchless banking is a result of long experience of working with institutions and consulting agencies in India.

Rakhi Sahay, Shift Thought distributor in Indonesia, is a development professional with a deep interest in innovative channels that drive inclusive development. Rakhi’s interest in branchless banking is a result of long experience of working with institutions and consulting agencies in India.