As Facebook attempts to bounce back from some of the latest setbacks, it is interesting to hear about the launch of Libra and Calibra, in what seems to be more of an offensive, rather than defensive response.

What is Libra?

In describing their mission, Libra starts by touting the banked-unbanked statistics, as have most of the would-be disruptive services for the last couple of decades or so. The question this raised for me is whether all this has really been tailored to those currently shut out of the banking system. With that segment more pre-occupied by bread-and-butter services, schooling, healthcare and local spend, it seemed to me that this product, aimed at global money transfer and payments transactions may turn out to be more attractive to a different tribe. Facebook seems to have received similar feedback already, so perhaps there is more to this than currently meets the eye.

The service is underpinned by the Libra Blockchain, and a currency unit termed, not unexpectedly, Libra (LBR). Adoption has generally been the main sticking point in most of the services that failed to make it over the last decade. Knowing this, their proposed founding members list reads like a “Who’s Who” of the Payments ecosystem. We have though, seen such a line-up in many previous products that are no longer around today. Perhaps this time it will be different. It is still early days. With so much of industry learning available, succeeding this time should hopefully be simpler.

What is Calibra?

Calibra is the digital wallet service from Facebook, meant to be the wallet for Libra. It may be used as a standalone app or through the Facebook Messenger and WhatsApp platforms. A subsidiary of Facebook, it seems to be the main go-between into Libra, which Facebook seems to be keeping more at arm’s length, judging from the “Libra, 2 weeks in” blog from David Marcus.

The Libra Association has been set up as an independent organization in crypto-currency friendly Geneva, Switzerland. Arguably, as just one of the 28 initial Founding Members, Facebook is not the sole influencer. However with a charter yet to be put in place, the trust the market places in Facebook will still be a central issue for the success of this service.

How does all this connect into the Bitcoin ecosystem?

Libra appears to position itself as a peer of Bitcoin. It is built on Blockchain, as is Bitcoin. While Libra claims not to be as open as Bitcoin, it is designed to be open, as it is not restricted purely to members. Where exactly the “openness line” is drawn will probably be clearer in the coming days.

Unsurprisingly this has raised similar concerns for regulators and Central Banks as have crypto-currencies launched before, though given the reach of Facebook and recent events, concerns seem to be stronger. Chris Skinner who spent time looking at what’s been happening at the United Nations shares his views in “The Regulator’s View of Facebook’s Libra Currency”.

Future Outlook

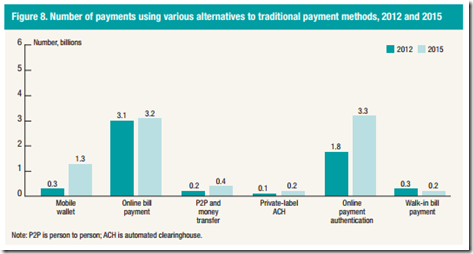

India’s base of tech-savvy consumers became a leading adopter that decided the fate of WhatsApp as a communications platform. An earlier P2P payments service from Facebook termed the WhatsApp payments service recently completed a pilot in India, offered to a million users. It now aims to rollout across the country, and is also being introduced in London. It will be interesting to see how that service pans out, and what the connection is to the new services planned. What is the future direction Facebook has in payments, how will all their acquired products fit in, and whether they will at last make the break through they have sought for so long – these are just some of the many questions that remain unanswered.

If any company is well aware of the network effect and how to use it, Facebook is. With experienced David Marcus involved there is undoubtedly a high degree of preparedness to be expected. So, they would well know how the closely-knit Indian community around the world could contribute to the success of these new products. At present though, Facebook claims to have ruled out plans for Calibra in India. The chosen markets and corridors will no doubt have an enormous impact on the success of these services.

For more on this, there is an infographic from MrBTC.org that aims to describe the crypto-currency in 5 minutes.

![clip_image002[4] clip_image002[4]](http://digitalmoney.shiftthought.com/files/2017/01/clip_image0024_thumb.jpg)