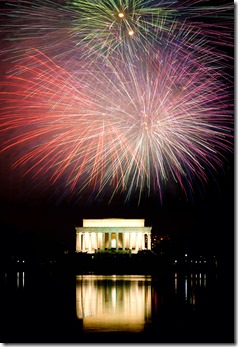

This weekend as we joined in wishing our American friends and family around the world a wonderful Independence Day, my thoughts turned to how Payment Systems are changing in historic ways in America, in many ways setting off a chain reaction that will transform the way we transfer value, not just in the US but world-wide.

The danger was that the land that introduced the first universal credit card back in 1950 had done such a good job of meeting consumer needs that it would be hard to get people to adopt new methods. It took a number of different initiatives of a decade or more to finally get this to happen.

Mobile Payments starts to take off at last

Did you know that mobile payments in America are expected to grow from $3.5b spent by 16 m shoppers in 2014 to a massive $27.5b by next year? Even then this will still be just a fraction of the $4.3t retail store payments made in the US. The common man or woman in America is seeing changes in the way they pay for tolls on the roads and how they pay each other, as well as pay bills and shop online.

Digital wallets – not there yet, but on the move

For the longest time it seemed as if this would not happen, especially after the strong push towards digital wallets in 2011 seemed to fizzle out. However now it seems this was simply the calm before the storm. Each side has reinforced itself as major battle commences to win hearts, minds and mobile wallets, but this time I believe what happens in America will not stay in America.

The US market becomes NFC-ready

Finally this year we have seen important moves towards new forms of mobile payments vi a NFC, QR Codes, MST, BLE and more, with a reported 70% increase in mobile commerce in the US since 2012.

On the one hand US POS is finally beginning to support EMV, as the October 2015 deadline looms. As the difference between the cost of contactless and non-contactless terminals is not vast, retail outlets are increasingly becoming NFC-ready.

Retailers look for online and mobile innovation

On the other hand top US Retailers have finally realised that the future of their brands depends on a golden braid of inextricably woven marketing and payments campaigns that rely on ever deeper market understanding to help get, keep and grow their customer base.

As in other countries, transport is becoming one of the first applications for consumer adoption of digital payments, as existing methods for paying get removed and replaced by new ones. Online payments are now widespread, but fear of loss of identity and security breaches still leaves a gap to be filled, causing a lot of focus on biometrics, authentication and fraud prevention. However for adoption to deepen across America the real driver will be offers and marketing campaigns.

Marketing and Payments: Perfect Partners

Here is where mobile payments comes into it’s own, with a unique appeal with respect to marketing. By 2016 over 196 million smartphone users become accessible to persuasion to buy in new ways. When Amazon was founded on July 5, 21 years ago (Happy Anniversary Amazon!), Jeff Bezos and team showed that deep understanding of what we want can actually be used to help us in finding what we’re looking for without proving overly offensive. Now we are at the cusp of a new revolution, as every possible route is being explored in pursuit of a new American Dream. The subtlety with which the new marketing capabilities are used will largely decide how quickly people adopt new payment methods.

Loyalty provides an incentive for change

Today store-issued credit cards and store rewards are being added to Apple Pay, Google Android Pay. Soon Walgreens hopes their 80 million members of Balance Rewards program will be able to use loyalty points with Apple Pay, and all eagerly anticipate smartphone, device and watch payments to increase. The new mobile payments methods will allow consumers to save on their shopping, by directly saving with the use of loyalty rewards.

American providers look for world markets

But this time American providers have a much larger canvas. If they get the digital loyalty-payments nexus right, there are other markets in a high state of readiness across the Atlantic that can help their brands grow. Apparently I am not the only one to leave my loyalty card behind, on the day when I find a retailer has one of their nicest sales on - in the UK unused loyalty cards reportedly cost us shoppers an estimated £5.2 billion.

The future – real time payments

But as I have said before, the real value comes when channels are made to properly work together, and this is what is starting to happen in the US. On my recent visit a short while ago I found payments really getting embedded into very interesting user experiences thanks to growing investment in FinTech.

Consumers and merchants are likely to see a lot of value-add over the coming months and years as Americans increasingly declare independence from cash payments, especially if payments can become real-time, something that has proven elusive until now. Importantly, it will not be long before the ecosystems grow beyond the US, and partnerships that are under formation now are likely to be important at least in the first phase of expansion.

Happy Independence Week America!