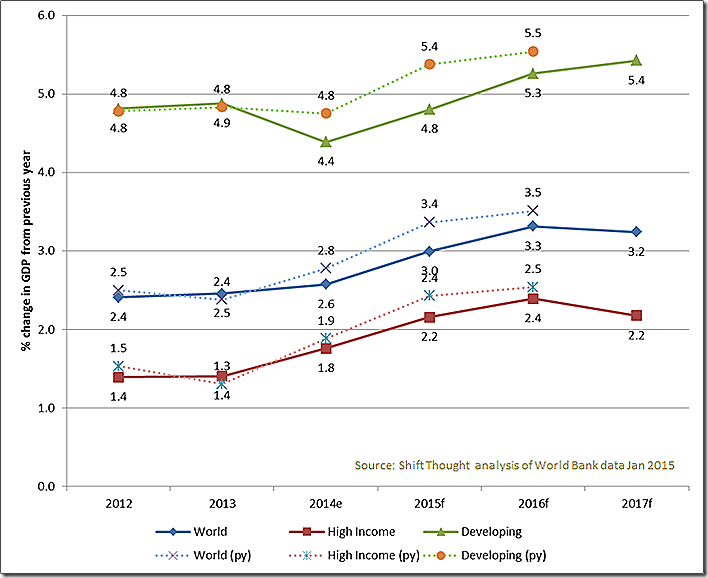

According to the Global Economic Prospects annual report from World Bank just released, growth in 2014 was lower than expected. Global growth is expected to rise moderately to 3% in 2015, while high-income countries will see a smaller growth of 2.2%. Developing countries fare better with a 4.8% increase.

Having just studied the report I thought I should share highlights to help explain why today Asian markets sank in early trading, copper prices fell and shares plummeted across Europe. Markets reacted to the World Bank’s decision to cut its economic forecasts for this year and next, in the Global Economic Prospects report just out.

Global trade has been weak in post-crisis years, growing less than 4% a year during 2012-2014, well below pre-crisis average annual growth of around 7%. Major forces driving global outlook include:

- Soft commodity prices

- Persistently low interest rates and divergent monetary policies across major economies

- Weak world trade

Recovery in 2014 in high-income economies was uneven. As many high-income grapple with fallout of global financial crisis, USA and UK have exceeded pre-crisis output peaks. The Euro Area and Middle-income economies face structural slowdown but low income economies are expected to enjoy a more robust growth.

Since mid-2014 the sharp decline in oil prices helps oil importing developing economies but dampens growth prospects for oil-exporting countries.

In the graph below I show last year’s forecasts in the dotted lines and this years (just released today) in solid lines. It is clear from this why markets reacted badly to the latest forecasts that show lower than expected figures across both high income and developing countries. Global growth is expected to rise moderately to 3 % in 2015. However high-income countries are likely to have a smaller growth of 2.2%. Developing countries will fare better i 2015 with a 4.8% increase.

The slowdown in global trade has been driven by cyclical factors such as persistently weak import demand in high-income countries and structural factors such as the changing relationship between trade and income.

Countries show divergent growth rates

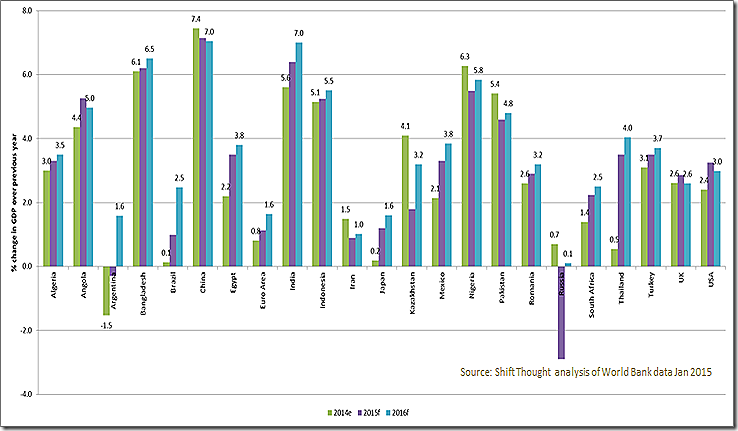

But how does this potentially impact on your market selection plans and strategy for this year? In the chart below I’ve shown the projections for key countries, with estimates for 2014-2016 annual percentage change in GDP.

To my mind this further calls into question the BRIC categorisation we use to describe emerging markets. Jim O’Neill of Goldman Sachs first used this term in 2001 to describe a group of countries that expanded rapidly in the 1990s. Today though, these countries increasingly show very different growth trajectories noted by some experts recently, and as I see exhibited in their recent economic profiles.

While in 2016 both India and China are likely to have a 7% percentage change in Real GDP, China arrives here on a decline, while India works up to this. India is expected to show a steady increase while a “disorderly slowdown” is expected in China. Brazil faced a steep decline in growth due to declines in commodity prices, weak growth in major trading partners, severe droughts in agricultural areas, election uncertainty, and contracting investment. Recession in Russia further distances this country from the BRIC group. Activity slowed to 0.7% in 2014 with on-going tensions with Ukraine, sanctions, falling crude oil prices and structural slowdown.

Growth in Europe and Central Asia slowed to a lower-than-expected 2.4 % in 2014 due to slow recovery in the Euro Area and stagnation in the Russian Federation. In contrast, growth in Turkey exceeded expectations despite slowing to around 3.1 %.

Geopolitical tensions, currently concentrated in Eastern Europe, the Middle East, and, to a lesser extent, South East

Asia, could rise in the short- and medium-term. In low-income countries, growth remained robust at about 6 % in 2014 attributed to rising public investment, robust capital inflows, good harvests (Ethiopia, Rwanda), and improving security in a few conflict countries such as Myanmar, Central African Republic and Mali.

Remittance flows still resilient

The good news is that remittance flows are expected to continue to exhibit a much welcome upward trend. As the risk to private capital flows to developing countries increases, the relative importance of remittances continues to grow. World Bank notes that during past sudden stops, when capital flows to developing countries fell on average by 25%, remittances increased by 7 %.

The forces driving the global outlook and the foreseen risks pose complex policy challenges according to the World Bank. Developing countries face major challenges. For one thing monetary and exchange rate policies will need to adapt as conditions return to normal. They also need to implement structural reforms to promote job creation. This is expected to help mitigate long-term adverse effects from less favourable demographics and weak global trade.

More detailed analysis of the latest economic prospects for each country and region is available in our “Digital Money in 2015” country reports. Drop me a line at contact@shiftthought.com if you’d like more information. The full Global Economic Prospects report and other resources are available at the World Bank website.