Today we are with Nitish Asthana of First Data, who provides insights on the fast moving payments scene in India, at this historic stage in the move towards non-cash payments. In this exclusive interview, we touch on key changes that could transform the card industry, and discuss a broad range of topics including E-tailing, Modern Retail, POS and the advent of mobile payments. Nitish shares four major trends that are transforming the way 1.2b consumers pay, as well as creating new opportunities in merchant-to-merchant payments potentially worth over $20b.

Thanks for taking time out from your busy schedule Nitish! As context please could you share a bit about yourself and your role at First Data?

I am the VP & Head of First Data India Ventures and have also led First Data’s merchant acquiring business in India. At First Data India ventures, we focus on venture investments in POS, e-commerce, mobile commerce and digital payments.

First Data is the global leader in payment technology and services solutions, operating in over 70 countries with relationships with over 3,500 Financial Institutions and offers a range of services including POS, E-Commerce and mobile (on internet and POS).

In India we are one of the leading merchant acquirers, providing services to over 250,000 merchants. First Data operates through an alliance with ICICI Bank (India’s largest private sector bank), ICICI Merchant Services. Our two lines of business are Merchant Services and Issuing. We offer POS, online, mobile and merchant processing and settlement for a broad range of consumer and business payments. Our issuing platform business runs on VisionPLUS, a First Data product and powers our service to leading banks in India.

Nitish, from your key perspective, which market segments seem to hold the most promise?

Activity in the payments space crosses a wide range of transactions across a set of vertical and horizontal segments.

In terms of vertical segments, E-commerce and especially E-tailing (Retail Sales on the Internet) is really important for us. Travel booking on the internet is already heavily penetrated, covering almost 100% of bookings and accounting for 75%-80% of online payments but this is fast reducing to 55% as online payments for retail, telecoms, utilities, insurance and tax take off. We also talk about point-of-sale (POS) as a vertical, within which Modern Retail is progressing very well, growing from just 5% of retail to 20% by 2020.

In terms of horizontal segmentation, large merchants of the country have already progressed in electronic payment, but today we see a lot more opportunity with small stores that accept only cash.

Overall in the market today card payments is a very small market as compared to US, UK, Australia and others but we expect 25-35% growth over the next few years.

The overall economic trends are also looking up?

Certainly, if you look at GDP growth, positivity is back! We are looking at a 7.5% growth in GDP expected to be the highest in the world.

A bigger driver for electronic payments is that currently over 90% of retail payments are in cash. The Government vision for less-cash is expected to bring out specific exemptions. Some are likely to relate to tax incentives for merchants and consumers to pay electronically.

If that happens, what is expected to be a $150b card industry over next 4 years could be pushed 50% higher going up to $250b-$275b by 2020. This would be much higher than current estimates, and we would reach an inflection point sooner with this planned government intervention.

What about the progress of Aadhaar-linked bank accounts and other key enablers?

Aadhaar has been an incredible journey with millions of customers enrolled. This received a massive boost from the launch of the Pradhan Mantri Jan Dhan Yojana (Prime Minister’s Benefit Fund) launched a year ago. It has created the rails to transfer benefits from the government, for instance LPG and fertilizer subsidy. NPCI recently confirmed that over 150m bank accounts have already been linked to Aadhaar numbers. All 170m beneficiaries were to be brought under the program by June 30, 2015. Banking inclusion has been greatly enhanced.

Regarding debit card infrastructure, India now has over 560m debit cards. Credit cards have been leading in the last 25 years, but debit cards are a more recent development. 60% of payment volumes are on credit cards despite them being fewer in number. The story so far was around credit but will be around debit cards going forward. I expect the ratio to reach 75% debit to 25% credit in terms of payment volumes.

In short we have a number of key enablers working together: the Aadhaar system enrolling people into electronic id, the push to mobile banking for the unbanked, the push to bank accounts, the roll out of debit cards and new POS infrastructure.

Could you please explain India’s position on merchant infrastructure?

In terms of a high level snapshot on merchant acceptance infrastructure, India has about 15 million merchants of which only 1 million accept cards. This is why card payments traction is so low. The barrier to acceptance is that terminal infrastructure is expensive, at a cost of around $150 - $200 per terminal. At this level return on investment on new terminals is difficult to justify. We have focused on bringing down the cost of a terminal to $25-$30, through the use of mobile POS. When you look at the last 8-9m merchants, mobile to mobile payments without infrastructure is the way to go.

First Data has launched our Pogo solution in July 2014, deployed at smaller merchants. At current take up levels the price point is higher but merchants do not pay upfront, we recoup the cost from on-going payments.

First Data has launched our Pogo solution in July 2014, deployed at smaller merchants. At current take up levels the price point is higher but merchants do not pay upfront, we recoup the cost from on-going payments.

Could you tell us about the new services you launched recently?

We are one of the leaders in E-Commerce payments and operate across a number of categories. To simplify customer experience we are looking to launch our revamped internet payment gateway which would also work from mobile phones. Universal payment options also cover internet banking, integration to wallets, EMI products, payment in home currency and seamless plug in to all shopping carts and a mobile optimized interface as well. We are looking to launch this in next 2-3 months.

We are also adding a number of features to our MPOS launched last year. At that level of transactions we can simplify documentation for a merchant to quickly come on board. We’re launching a product for payments and other applications such as ERP, accounting, loyalty and a hardware/software.

Essentially small sized retailers have not invested in counter top infrastructure. Some may have PCs, some may not even have that. What we want to provide is a package deal for a small player by “miniaturising” the functionality used by large merchants: ERP, bar code reader, printer and other features. We believe that addressing the needs of small merchants is of great importance.

How about merchant to merchant applications and do you have estimates on how much the India B2B market is worth?

If you look at B2B, that too is very interesting for us as we address cash and carry. In India the market includes stores such as Walmart and Metro Cash and Carry. We’ve done a prepaid program, also a credit card with limit, accepted by closed group of retailers. Other interesting opportunities are around travel, for low cost airlines to sell their inventory and enjoy more card acceptance. The third interesting area is procurement that can help both parties optimise working capital.

Our own best estimates for the size of the B2B market is $15b to $20b of available market across the country.

How has the Indian payments market changed over the last year?

The first major trend has been the move from credit to debit. In the past cards were used more for discretionary expense, now the trend is towards non-discretionary, as consumers use cards instead of cash in their wallet. Supermarkets are adopting cards and issuers have provided a lot more debit cards.

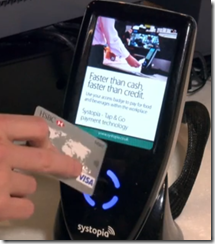

Secondly, it is contactless. We were the first to introduce contactless terminals. For small value transactions, you can now tap and go. I believe Contactless could be very important going forward.

The third trend is mobile especially through mobile internet. India has 900m mobile phones and 300m smartphones, growing to 500m. People prefer to shop on their mobile rather than using their laptops or PCs. This is higher even than the US, and considering how important the Indian market is apps are being rolled out and payment systems are evolving fast. Mobile optimised pages and plug-ins are being rolled out. We expect this market to reach $35 million.

The fourth major trend has been the growth of our local network, RuPay, similar to China UnionPay. In the past Visa and MasterCard held dominant positions in India, but issuance in the last 18 months has changed things. NPCI RuPay has issued a huge number of cards and will play a very important role as all the new bank accounts use RuPay.

How important will the physical card be in India?

I think plastic cards will continue to be very relevant in the near future. Mobile wallets have not been adopted as fast as hoped and have been around prepaid rather than card in store.

I believe however that the form of plastic will change though, with more Chip & PIN EMV cards being rolled out as we speak.

Do you have any idea of the number of contactless cards and terminals?

I’d say terminals accepting contactless cards are in the region of 20,000-25,000. Also, if you talk to top acquirers, they’re all talking of deploying a large number.

We expect pretty much all of our new deployments to be contactless this year. Over 80% of the transactions on POS are less than $30 and could qualify as contactless. Some categories would go better, for instance super-markets and transit.

Transport has not come up as much as it could, do you see this changing?

A number of metros are leading in the investment in tap and go. Toll is not yet integrated and as it is not interoperable it means that people cannot yet buy prepaid. With regard to Prepaid, services Mobikwik offers card payment service for Android and iOS users and now supports paying for Uber.

The form factor of cards will change, as this increasingly moves to Chip & PIN and contactless rather than magnetic stripe as the price of contactless terminals is not that much more.

What significant changes are likely in the way people pay in India over the near future?

We are keen to look at in particular in terms of how government participates. Deploying acceptance infrastructure and now systemic incentives will help non-cash payments to reach tipping point.

Everyone understands the cost of cash. The goal is to get people to prefer electronic payments over cash. However affinity to cash is too high and must be broken. Government incentives made available to all, including merchants, consumers, acquiring banks and others, will help to lower costs and promote adoption.

Nitish, thanks for sharing your insights with us. I wish you the very best for your initiatives as India continues to adopt non-cash payments at this unprecedented pace.

Nitish Asthana is the VP and Head of First Data India Ventures, focused on venture investments in POS, e-commerce, mobile commerce and digital payments. He has led the merchant acquiring business for First Data- ICICI Merchant Services (ICICI MS) and had overall responsibility over ICICI MS revenue lines across the company’s POS and Ecommerce businesses, acceptance and acquiring product solutions, sales, business development and marketing.

Nitish Asthana is the VP and Head of First Data India Ventures, focused on venture investments in POS, e-commerce, mobile commerce and digital payments. He has led the merchant acquiring business for First Data- ICICI Merchant Services (ICICI MS) and had overall responsibility over ICICI MS revenue lines across the company’s POS and Ecommerce businesses, acceptance and acquiring product solutions, sales, business development and marketing.

For more information on “Digital Money in India”, Shift Thought’s unique 360-degree coverage of the Indian payments scene, or to gain access our self-service portal with the latest knowledge on the ecosystem, initiatives, regulations and more, just email us at contact@shifttthought.com.

For more information on “Digital Money in India”, Shift Thought’s unique 360-degree coverage of the Indian payments scene, or to gain access our self-service portal with the latest knowledge on the ecosystem, initiatives, regulations and more, just email us at contact@shifttthought.com.

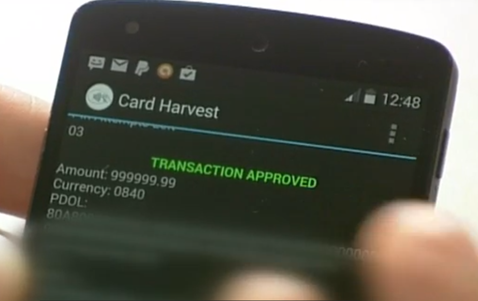

Really I have two major roles at Visa Europe. Firstly, to look at emerging technologies and gauge what our involvement should be. Is this a technology so impactful we must do something about it but not necessarily be a provider? A good example of this could be authentication or identity, where it’s probably more about us adapting our product rules and frameworks to recognise emerging technologies. Alternatively, is it a service we should provide as part of our core services? A good example of this might be tokenisation, or incorporating geo-fencing into our services as a way of improving our authorisation services and improving the customer experience to approve genuine transactions and help capture fraudulent ones.

Really I have two major roles at Visa Europe. Firstly, to look at emerging technologies and gauge what our involvement should be. Is this a technology so impactful we must do something about it but not necessarily be a provider? A good example of this could be authentication or identity, where it’s probably more about us adapting our product rules and frameworks to recognise emerging technologies. Alternatively, is it a service we should provide as part of our core services? A good example of this might be tokenisation, or incorporating geo-fencing into our services as a way of improving our authorisation services and improving the customer experience to approve genuine transactions and help capture fraudulent ones.