As debates on the regulation of Bitcoin and cyber currencies continue to build up, Karena de Souza, Shift Thought distributor in Canada recently chatted with people involved in the rapidly growing Canadian Bitcoin ecosystem. She shares her thoughts here and we raise key questions to reflect on.

Background

News on Bitcoin alternates from viral growth to free fall. Fuelled by a meteoric rise in value based on announcements and events over November 2013, phrases such as ‘cyber currency’, ‘digital money’ and ‘virtual currency’ have entered the common vernacular. Press releases, announcements and senate hearings have all worked to keep it front and present in the public eye. The word ‘bitcoin’ made its official entry into the Oxford Dictionary in August 2013.

Bitcoin is now getting the visibility it has been struggling for since its inception, as Forbes reported 2013 to be the Year of the Bitcoin. The European Banking Authority has now warned consumers of the risks, as China’s PBOC barred financial institutions from handling Bitcoin transactions last week.

It is important to clarify that at Shift Thought we look at Bitcoin as just one example of a class of virtual currencies, not to be confused with our description of Digital Money, the term we use for describing innovations that move people away from paying with cash.

What is Bitcoin?

After the recent interest, most major financial news agencies have published an explanation of Bitcoin – how it is created and how it works. The Bitcoin community maintains a comprehensive FAQ. I recommend the Huffington Post: A three part series by Alexandra Berke as an easy introductory read. A Fistful of Bitcoins is a more in-depth discussion of algorithms and the concept of anonymity.

Value versus Volatility

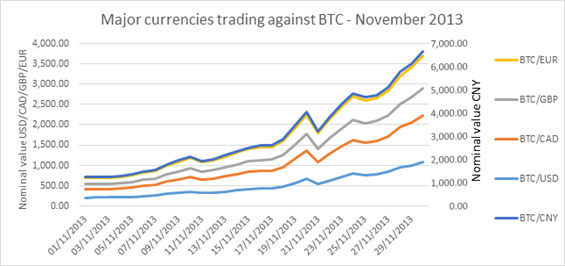

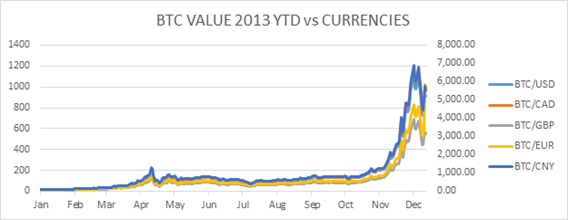

Key announcements, particularly from China and the USA, have kept the focus on Bitcoin and other virtual currencies, causing a rise and fall in the value and sudden surges in demand. After trading within the $10-$200 USD bracket for most of 2013, the value of a Bitcoin jumped 400% within the month of November.

The graphs, sourced from OANDA Historical Exchange Rates show more volatility in the price of BTC based on daily announcements, primarily out of China, not so far a total reversal in value.

As more consumers get comfortable with the concept of a virtual currency, especially in markets as large as the USA and China, the opportunity for a digital currency with low transaction costs to succeed gets larger. As discussed in the Shift Thought webinar on Digital Money in China 2013, the online purchasing population of that country is bigger than the entire population of the 5th most populous country in the world. Announcements out of China therefore have the ability to create huge swings in a cyber-currency still in its infancy.

Bitcoin operates as a cyber currency that provides users in many countries with a way to transfer value internationally at a nominal rate, without a bank account. The effect on remittance streams could be significant, causing leading global payment providers to consider whether and when to support it. However the potential effect on consumers could be catastrophic. Also of great concern to the regulatory community is the cash-like anonymity this method offers, and the potential for exploitation by money launderers and criminal elements.

To hoard or to trade?

Creating the expectation that there will only ever be 21 million Bitcoins helped its value to rise dramatically and also fuelled an instinct to hoard. Yet hoarding goes against the effectiveness of a means of payment.

VirtEx, The Canadian Virtual Exchange has been building a bitcoin ecosystem by working with merchants and customers.

VirtEx, The Canadian Virtual Exchange has been building a bitcoin ecosystem by working with merchants and customers.

At the Small Business Forum in Toronto on October 23, 2013 (1BTC=$183.69 CAD) CEO Joseph David encouraged small businesses to consider becoming a part of the Bitcoin network. They are attempting to take Bitcoin beyond cyber commerce, to make it viable tender at an expanding number of brick and mortar sites. They use the appeal of low transaction fees, quick access to money and the cash-like anonymous relationship to the transaction. VirtEx claims to have a rigorous identification process in place before it will establish an account. It supports a range of Bitcoin related activity and has expanded its portfolio of products most recently by launching a Schedule 1 bank-based debit card. This allows Canadians to use the Interac network to spend Bitcoin or withdraw the Canadian Dollar equivalent in cash, within the guidelines established. VirtEx stated aim is to provide the Canadian Bitcoin community with a secure place to trade in Bitcoin.

The increase in awareness amongst the general population, coupled with the growing value of BTC (the Bitcoin currency) has certainly got more merchants considering acceptance of Bitcoin as tender. But could the recent volatility scare smaller merchants who are dependent on a predictable cash flow? Will we start seeing protective hedging in the form of options and futures? Virtex Business Development Manager Reed Holmes hoped that by encouraging a robust and ever-increasing circle of suppliers that are willing to accept Bitcoin internationally, merchants will keep their transactions in BTC, opting to convert to fiat currencies only when necessary. While it is good to see BTC appreciate in value, there is hope that instead of hoarding, sufficient amounts of BTC will stay in regular circulation and like gold, be ‘on display’.

Bitcoin in Canada

Canada is a perfect incubator for ideas and innovation – the smaller, concentrated population with a high degree of technical and financial knowledge, is coupled with a conservative yet open-minded, internationally respected regulatory environment. The significant proportion of immigrants helps the osmosis of good ideas back to their countries of origin. This has created conditions for large numbers of Canadians to embrace Bitcoin. The world’s first bitcoin ATM was launched in Vancouver, with more planned. According to Isabell Boese, Executive Assistant at Bitcoiniacs, the second Robocoin ATM is to be installed in Calgary by year-end, and the first of two earmarked for Toronto will be in place by end of January 2014.

Canada is a perfect incubator for ideas and innovation – the smaller, concentrated population with a high degree of technical and financial knowledge, is coupled with a conservative yet open-minded, internationally respected regulatory environment. The significant proportion of immigrants helps the osmosis of good ideas back to their countries of origin. This has created conditions for large numbers of Canadians to embrace Bitcoin. The world’s first bitcoin ATM was launched in Vancouver, with more planned. According to Isabell Boese, Executive Assistant at Bitcoiniacs, the second Robocoin ATM is to be installed in Calgary by year-end, and the first of two earmarked for Toronto will be in place by end of January 2014.

That should be well in time for the first bitcoin Expo to be hosted in Toronto April 11-13, 2014. At that event, Canada will look to establish itself as an innovator and leader in this space. It aims to attract merchants, start-ups, VCs and investors who are interested in fostering the ‘growth and development of Bitcoin communities worldwide with a focus on collaborative and decentralized models’. It features an international panel of speakers as per the post from Anthony Di Iorio, Executive Director of the organizer, Bitcoin Alliance of Canada.

That should be well in time for the first bitcoin Expo to be hosted in Toronto April 11-13, 2014. At that event, Canada will look to establish itself as an innovator and leader in this space. It aims to attract merchants, start-ups, VCs and investors who are interested in fostering the ‘growth and development of Bitcoin communities worldwide with a focus on collaborative and decentralized models’. It features an international panel of speakers as per the post from Anthony Di Iorio, Executive Director of the organizer, Bitcoin Alliance of Canada.

There have been frequent announcements of Bitcoin related start-ups and ventures. At the Mobile Money Conference 2013 in November, Venture Capital Panelist Alex Baker forecast that the coming months and years would see Bitcoin play a more prominent and disruptive role in retail payment.

The Risks and Rewards

Bitcoin.org lays out the many risks with using this new payment method. Competitive cyber currency offerings, denouncement by sovereign countries and central banks and the fraud and embezzlements uncovered all conspire to affect the day-to-day value of BTC. Yet the international Bitcoin community and its supporters grow, as a new wave of digital payments joins the traditional cash, gold and credit remittance and payment streams.

For some hoping for a Bitcoin in their stockings, it seems they may have to be happy with a few Satoshi! I am taking the long view – I think virtual currency will be to payments what the smart phone was to the telephone and camera … it’s going to make new things possible!

Over to you …

- What is the innovative and disruptive element of Bitcoin that is likely to change payments?

- What effect do you see Bitcoin having on international remittances?

- Will Bitcoin still be the hot topic at the end of 2014?

- What does it take for a new payments method to go mainstream?

- Will Bitcoin have an impact on your business or way of doing business?

![image_thumb11[1] image_thumb11[1]](http://digitalmoney.shiftthought.com/files/2013/12/image_thumb111_thumb.png)

Karena de Souza is a forward thinking and entrepreneurial professional with a special interest in payment streams for small business. Karena’s focus on mobile finance blends the challenges and opportunites she faced as a small business owner in Canada with her experience using technology to facilitate financial services while at Morgan Stanley in New York. She graduated from the University of Westminster with a BSc (Hons) Mathematics and Computing.

![image_thumb11[1] image_thumb11[1]](http://digitalmoney.shiftthought.com/files/2013/12/image_thumb111_thumb.png)